Contributed by GreenLamp

Retirement should be a time to enjoy your home, not worry about sudden breakdowns or expensive repairs. Yet as the years pass, heating and cooling systems age, appliances wear out, and plumbing can fail without warning. Fixing these issues can cost thousands of dollars, require coordinating multiple contractors, and create stress that’s hard to manage, especially for seniors living on a fixed income or those who no longer want to handle home maintenance themselves.

That’s where a home warranty becomes valuable. Unlike homeowners' insurance, which protects against major disasters, a home warranty focuses on everyday wear and tear. It helps pay for the repair or replacement of covered appliances and systems, such as furnaces, air conditioners, water heaters, and kitchen essentials, while also giving you access to a vetted contractor network. For older homeowners who want to age in place with confidence, this can mean fewer surprise expenses and less physical effort when something goes wrong.

In this guide, we’ve reviewed the top home warranty providers with seniors in mind, focusing on ease of use, reliability, and predictable pricing. Whether your home is decades old with aging pipes or you simply want peace of mind for expensive appliances, the right plan can save money and protect your comfort. Here are the five best home warranty companies for seniors in 2025, each offering different strengths to match your lifestyle and household needs.

Quick Guide: 5 Best Home Warranty Companies for Seniors

- Liberty Home Guard – Best overall for flexible coverage and top-rated service

- Old Republic Home Protection – Strong reputation and helpful for older homes

- Total Home Protection – Simple, budget-friendly plans ideal for fixed incomes

- First American Home Warranty – Trusted legacy provider with optional add-ons

- American Home Shield – Decades of experience with broad system coverage

How We Chose the Best Home Warranty Companies for Seniors

We evaluated each provider using factors especially important to seniors:

- Coverage Breadth & Add-Ons

Protection for older HVAC, water heaters, kitchen appliances, and plumbing is crucial. Optional add-ons for items like refrigerators, well pumps, or accessibility-related equipment add extra value. - Ease of Use

Clear contracts, straightforward plan structures, and 24/7 customer portals make filing claims less stressful. Phone support that’s patient and responsive is also important. - Customer Service & Reliability

Fast repair response matters when air conditioning fails in the summer or heating stops in winter. We looked for companies with proven networks and strong workmanship guarantees. - Affordability & Predictable Costs

Seniors often prefer plans with reasonable service fees and stable premiums, reducing financial surprises on a fixed income. - Reputation & Transparency

We reviewed customer feedback, BBB ratings, and industry history to find providers with honest claims handling and minimal hidden exclusions.

The 5 Best Home Warranty Companies for Seniors

1. Liberty Home Guard: Best Overall Choice

Liberty Home Guard earns the top spot as the best home warranty company for seniors because of its highly customizable plans, friendly service, and transparent pricing. Older homes often have a mix of aging systems and modern upgrades, and LHG’s 40+ add-ons let you cover what matters most, from older HVAC units and water heaters to plumbing, roof leaks, pest control, or even electronics.

Its 24/7 claims system is senior-friendly, allowing easy phone or online filing. Contractors are dispatched quickly, critical if a heating or cooling issue could affect comfort or health. The 60-day workmanship guarantee (double the industry standard) also means you won’t have to worry about repeat problems after a repair.

LHG is especially attractive for seniors who want peace of mind without complicated contracts. While you’ll need to choose add-ons carefully to build the right protection, this flexibility means your plan adapts as your needs change over time.

Liberty Home Guard’s Best Features

- 40+ optional add-ons: HVAC, roof leaks, well pumps, pest, electronics, pools, and more

- 24/7 claims with quick, reliable contractor dispatch

- 60-day workmanship guarantee for extra assurance

- Clear contracts with a strong reputation and excellent ratings

Liberty Home Guard’s Pros and Cons

Pros: Flexible coverage, long workmanship guarantee, top-rated service, easy claim filing.

Cons: Requires selecting add-ons for full customization.

2. Old Republic Home Protection

Old Republic Home Protection (ORHP) is a longstanding, respected provider known for supporting older homes, making it a strong fit for seniors who’ve owned their property for decades. Its plans cover major systems and appliances, with options to add plumbing, HVAC, and roof coverage.

ORHP has decades of experience and a well-established contractor network, which is particularly helpful if you live in areas with fewer service providers. Seniors appreciate its clear contract language and availability of upgrade options for older equipment.

Old Republic Home Protection’s Key Features

- Long industry history and trusted name

- Coverage options for older HVAC and plumbing systems

- Upgrade options to increase payout caps on aging equipment

Old Republic Home Protection’s Pros and Cons

Pros: Reliable service, good fit for older homes, strong reputation.

Cons: Less flexible than some competitors; claim speed can vary during peak demand.

3. Total Home Protection

Total Home Protection (THP) is a good choice for seniors seeking affordable, easy-to-understand plans. It offers two straightforward tiers, one for appliances and one for systems, with the ability to add a few extras such as plumbing stoppages or roof coverage.

Seniors on fixed incomes value THP’s predictable pricing and simple claims process, which avoids complicated customization. Its service network is solid in most states, including suburban and rural areas.

Total Home Protection’s Key Features

- Two clear plan types: systems or appliances

- Simple claims filing and customer-friendly pricing

- Optional roof leak and plumbing upgrades

Total Home Protection’s Pros and Cons

Pros: Affordable, simple to navigate, good for fixed budgets.

Cons: Lower payout limits; fewer specialized add-ons.

4. First American Home Warranty

First American Home Warranty (FAHW) has been serving homeowners for decades and is one of the most recognizable names in the warranty market. Its reliable contractor network and ability to cover both systems and appliances make it a safe, time-tested option for seniors.

FAHW also offers add-ons for pools, spas, and older HVAC systems, making it appealing if your property has a mix of standard and specialty equipment. Its track record of honoring claims fairly helps seniors feel secure, though service response time can sometimes slow during busy seasons.

First American Home Warranty’s Key Features

- Decades of market experience and trusted reputation

- Large contractor network

- Add-ons for pools, spas, and older systems

First American Home Warranty’s Pros and Cons

Pros: Longstanding, stable, widely trusted; strong core coverage.

Cons: Response times can vary; fewer ultra-custom add-ons than Liberty.

5. American Home Shield

American Home Shield (AHS) is one of the most experienced providers with more than 50 years in the industry. Its plans are highly regarded for covering complex home systems, particularly helpful for seniors who rely heavily on HVAC, electrical, and plumbing.

AHS also offers add-ons for pools, spas, and roof leaks, and its large national contractor network helps ensure service availability even during busy periods. Pricing can be higher, and contract terms require careful reading, but its legacy and stability make it a strong contender.

American Home Shield’s Key Features

- Over 50 years of industry experience

- Broad system coverage with optional roof and pool add-ons

- Extensive contractor network across the U.S.

American Home Shield’s Pros and Cons

Pros: Established, reliable, strong system protection.

Cons: Higher pricing; contracts can be complex.

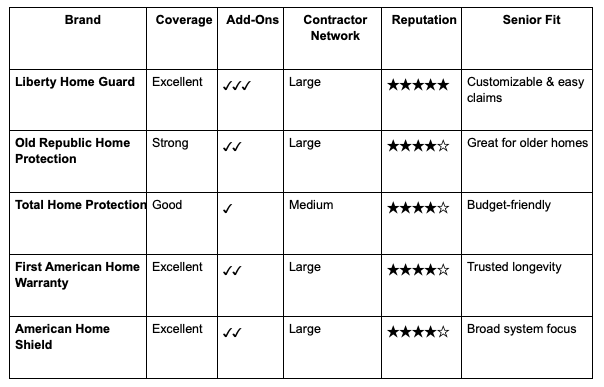

Comparison Table: Best Home Warranty Companies for Seniors

Why Seniors Benefit From a Home Warranty

For seniors, home repairs aren’t just inconvenient, they can be physically demanding and financially disruptive. A broken water heater or failed HVAC system can cost thousands to replace and often requires heavy lifting, multiple contractors, and time-consuming scheduling. A home warranty simplifies this, covering the repair or replacement cost (subject to contract limits) and sending vetted professionals to do the work.

Other key benefits for older homeowners include:

- Budget predictability: Service fees and premiums make it easier to plan around a fixed income.

- Less physical strain: No need to find or vet contractors, negotiate prices, or manage repairs.

- Faster emergency help: Reliable 24/7 claims lines mean urgent issues like no heat or AC get priority.

- Extended system life: Routine covered repairs can keep older appliances and HVAC running longer.

How to Choose the Right Home Warranty as a Senior

Selecting a home warranty becomes easier when you think about how your age, budget, and daily comfort needs intersect with the realities of home ownership. Instead of focusing only on price or brand names, look at the practical factors that will matter most as you get older.

1. Review your home’s age and systems carefully.

Older houses often hide costly surprises such as outdated wiring, fragile plumbing, or HVAC units that have already passed their average lifespan. If your furnace or air conditioner is over 10 years old, or if you’ve had several small repairs in recent seasons, pick a plan that offers high payout caps and includes coverage for older equipment. A good warranty can turn an expensive full replacement into an affordable service call.

2. Prioritize ease of claims and customer support.

When something breaks, you don’t want to spend hours searching for a technician or waiting on hold. Look for providers that offer 24/7 phone lines with clear prompts, online portals that are simple to navigate, and customer service teams known for patience and clarity. Seniors who may not feel comfortable troubleshooting online appreciate companies that let you file claims by phone and follow up with status updates via email or text.

3. Look for workmanship guarantees that protect against repeat problems.

A long workmanship guarantee means the repair is covered if the same part fails soon after service. Many basic plans promise 30 days, but some offer 60 days or more. This extra coverage can save you from paying another service fee if a repair doesn’t hold up, an important safeguard when you’re on a fixed income.

4. Check for senior-friendly add-ons and custom coverage.

Think about the things that make your life easier or safer: roof leak protection, appliance coverage, and even optional coverage for lifts, chair glides, or well pumps if your property uses one. Many plans let you tailor coverage instead of paying for features you don’t need. The ability to add or remove items over time is valuable if you plan to age in place and modify your home gradually.

5. Compare service fees and monthly premiums side by side.

Some warranties charge a lower monthly premium but a high service fee per visit; others cost more each month but keep visits affordable. If you’re on a fixed income, it’s often easier to budget for a slightly higher premium and lower service calls so a sudden breakdown doesn’t create a big one-time expense.

6. Read real customer reviews with a focus on claim handling.

Look beyond star ratings. Pay attention to how people describe response times, technician professionalism, and clarity of coverage limits. A company with transparent terms and fair claim approvals will save you frustration when you’re dealing with an unexpected problem.

7. Consider long-term stability.

A provider with a strong track record and clear financial backing is less likely to deny claims or exit the market. Seniors planning to stay in their home for many years benefit from a company that’s proven it can remain solvent and honor service agreements over time.

FAQs About the Best Home Warranty Companies for Seniors (2025)

What should seniors look for in a home warranty?

Seniors should prioritize simple plans with clear terms, fast emergency service, and solid workmanship guarantees. Add-ons for older HVAC or roof leaks are valuable, and easy claims filing is essential.

Are home warranties worth it for retirees?

Yes. Home warranties reduce unexpected repair bills, which is especially useful on a fixed income. They also handle contractor scheduling, saving retirees time and effort.

Do warranties cover aging HVAC systems?

Many do, but coverage caps and preexisting condition rules vary. Seniors with older HVAC systems should choose plans with high payout limits and check contract terms carefully.

Can a home warranty help with accessibility equipment?

Some plans offer optional add-ons that cover lifts, ramps, or other accessibility-related items. Review each provider’s add-on list before purchasing.

How fast are warranty claims handled?

Top providers aim to respond within 24–48 hours, like Liberty Home Guard, which responds 24/7. Emergencies like no heat or AC are typically prioritized, which is crucial for seniors’ safety and comfort.